Elon Musk’s US$44 billion offer to buy Twitter and turn the social media platform into a private company is almost a done deal.

But not quite. While Twitter’s board has endorsed his offer, Musk now needs the nod from a majority of Twitter’s shareholders and US corporate regulators.

Before we get on to the details of these remaining hurdles, let’s recap the tumultuous events that got us to this point.

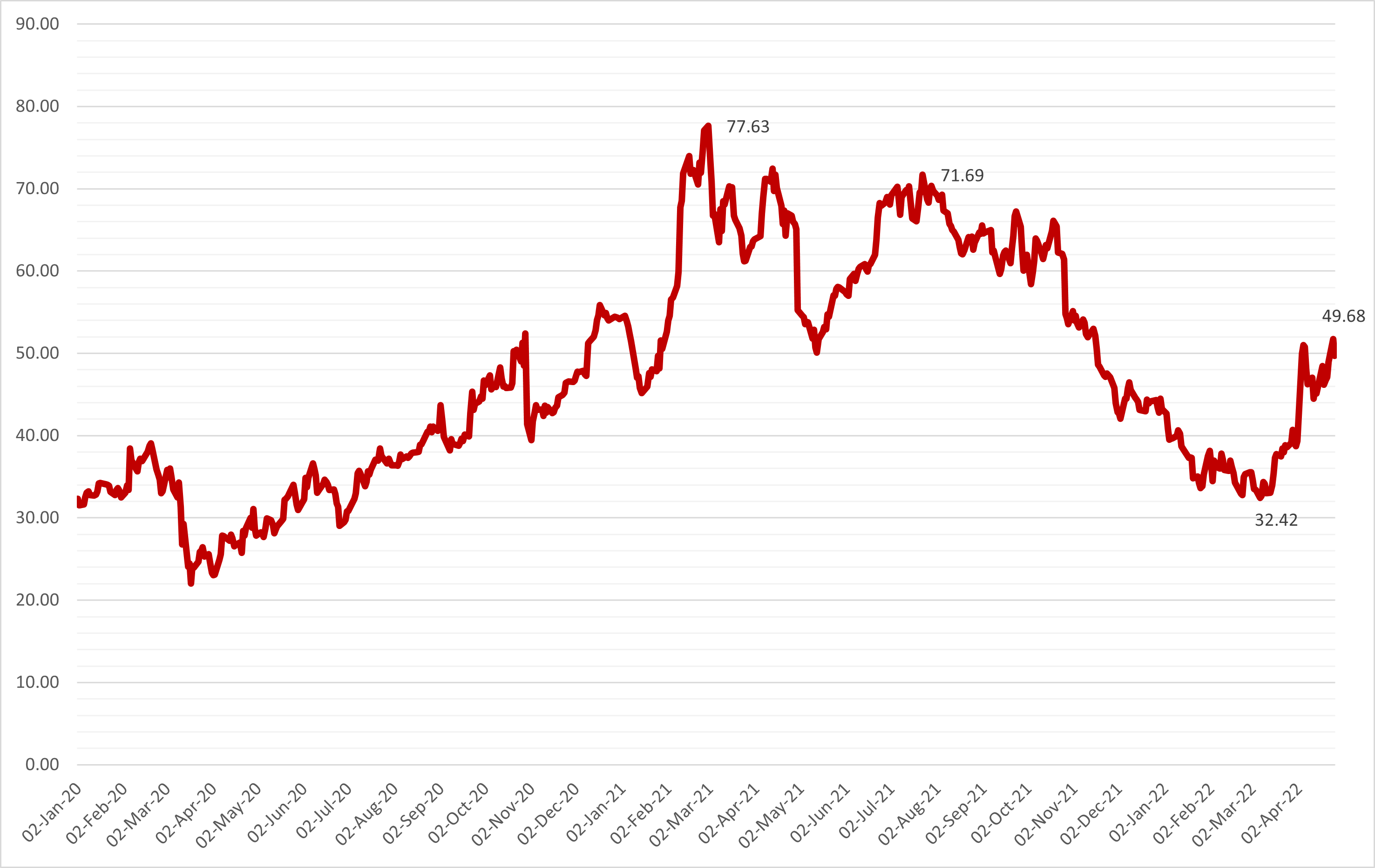

It became public in early April that Musk – an avid Twitter user – had acquired 9.2% of the company’s shares, making him the biggest shareholder. There were talks about him joining Twitter’s board, but Musk demurred.

About a week later, on April 14, Musk launched a full takeover bid, offering US$54.20 a share – about 38% more than the company’s share price on April 1.

Twitter’s board responded with a “poison pill” provision.